ELAP 10xJACW.

,, 7%

|Wiers, ir., ..

Fine bירות.

#Niki drabلا vaysن, drajely s.

-JavaScriptly, driley, n.

Sirovné.

—

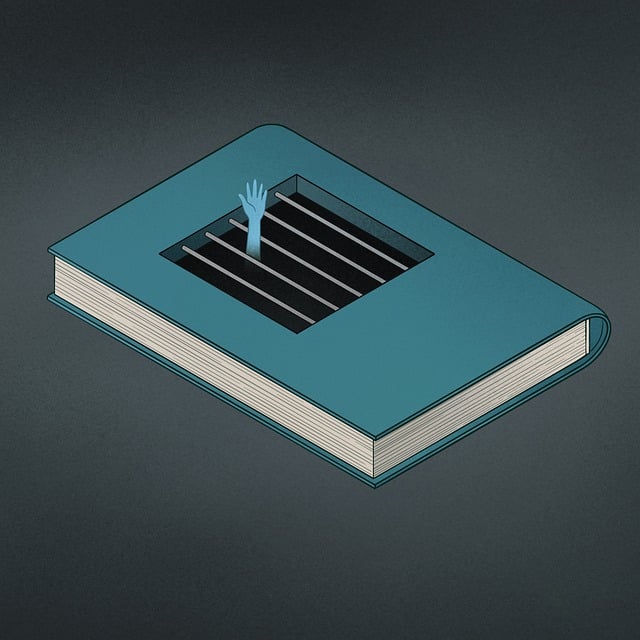

Home ownership, often viewed as a dream, serves as a powerful asset protection strategy. This article explores how purchasing property can safeguard financial future, especially in Canada’s unique legal context. We delve into the Canadian Youth Criminal Justice Act (YCJA) and its implications for young homeowners, particularly regarding Juvenile DUI charges. Understanding these factors is crucial for prospective buyers to make informed decisions and protect their investment while navigating legal complexities.

- Understanding Home Ownership as an Asset Protection Strategy

- Canadian YCJA and Juvenile DUI: Implications for Young Owners

Understanding Home Ownership as an Asset Protection Strategy

Understanding home ownership as an asset protection strategy is a crucial consideration for individuals, especially in Canada where youth criminal justice (Canadian YCJA) and juvenile DUI cases are not uncommon. While these legal matters can significantly impact a young person’s future, owning property can serve as a protective measure and offer a sense of stability. By establishing homeownership, individuals gain control over their assets and create a financial buffer against potential legal consequences.

In the context of Canadian YCJA and Juvenile DUI, where rehabilitation and second chances are key, home ownership provides a tangible asset to build upon. It allows for investment in future endeavors, whether it’s starting a business or pursuing higher education, which can help divert attention from past mistakes and foster positive growth. This strategic approach to asset protection through real estate is particularly relevant for young adults navigating the legal system and looking towards a brighter future.

Canadian YCJA and Juvenile DUI: Implications for Young Owners

In Canada, the Youth Criminal Justice Act (YCJA) plays a significant role in shaping the legal landscape for young people, including those who may face charges related to DUI (Driving Under the Influence). This act is designed to address juvenile crime while promoting rehabilitation and reintegration into society. When it comes to home ownership, young individuals facing charges under the YCJA and specifically, Juvenile DUI, need to be aware of its potential implications.

A conviction for DUI as a minor can have long-term effects on future asset acquisition, especially when pursuing homeownership. The Canadian YCJA emphasizes accountability and rehabilitation, which might involve various sanctions, including community service, fines, or even imprisonment. These measures can impact a young person’s financial stability, credit score, and overall ability to secure a mortgage. As such, it is crucial for those facing these charges to understand the legal process and explore options that can mitigate potential barriers to future home ownership.

Home ownership can be a powerful tool for asset protection, providing both financial stability and legal safeguards. However, it’s crucial to consider the implications of juvenile actions like DUI under the Canadian YCJA (Young Offenders Act). Understanding these dynamics ensures that young owners make informed decisions, navigating the legal landscape while safeguarding their future financial well-being.